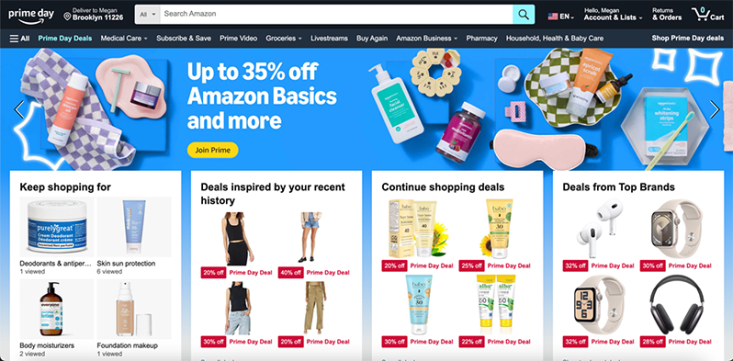

“Amazon’s biggest Prime Day shopping event ever” – that was the press release headline with the stats to back it up. In its 10th year, Prime Day notched up its strongest growth rate since the height of COVID in 2020, fueled by steeper deal discounts, peaking up to 10% higher than 2023, according to Adobe Analytics. (The emphasis was firmly on % discount rather than $ off – somewhat controversial, because Amazon calculates savings based on MSRP/list, not the regular selling price.). Our VML Commerce team had eyes across the world, tracking the sales, trends and key themes represented across the global marketplace.

Firstly, it’s important not toforget the origins of Prime Day as a membership recruitment drive, with Amazon reporting that a “record-breaking number of customers signed up for Prime in the three weeks leading up to Prime Day, with millions of new members worldwide”.

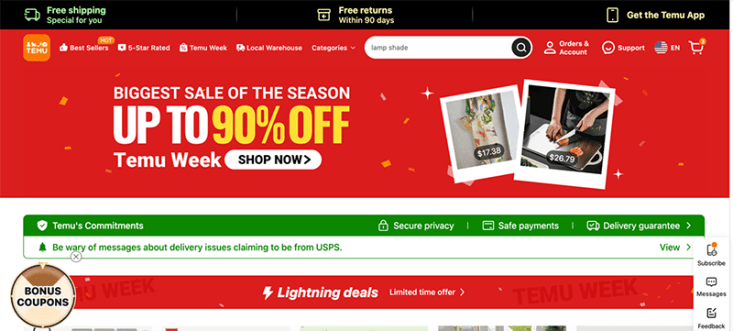

Today, Prime Day has become the unofficial start of the shopping season, leading into Back-to-School and the holidays. This year, the competition took a clear swing at the dollars on the table by staging their own events – including traditional retailers like Walmart and Target, social players such as TikTok and new marketplaces like Temu. Walmart pulled out all the stops with a 50% off offer on its own membership program – Walmart+.